WHY BUSINESS INTELLIGENCE IS VITAL TO THE SUCCESS OF THE INSURANCE INDUSTRY

by

The most important asset to ensure survival and success in today’s marketplace is data. Business Intelligence converts this raw data into actionable information.

The internet, deregulation, increased competition, consolidation and convergence of insurance services with other financial services have changed the structure of the insurance industry. This has greatly increased the need to implement business intelligence tools within insurance companies.

BI refers to collecting, analyzing, presenting and disseminating business data. In an insurance company, this would be data sourced from Sales, Claims, Marketing and Premiums etc. BI tools ensure that data from these sources can be tapped at the ready to provide insight.

Business Intelligence delivers clear and focused information in the following avenues.

Customer Satisfaction and Retention

Data captured at individual customer contact points. This provides data that makes it easy to identify the most profitable customers, understand needs and buying patterns of customers.

New products are also easily designed to prevent customer attrition and retain current profitable customers.

Channel management

Business intelligence tools drive strong channel alignment by allowing analysis of the performance of various channels. Insurance companies have relied on independent agents, brokers, and direct sales force for distributing their products. These are still the primary distribution channels. With the increased use of the internet among markets, tracking performance measures effectiveness and enables developmental actions to be taken to ensure that the proper channels are being used to distribute products.

Claims management and estimation

BI tools can be used to perform analysis of claims data across the enterprise and customer segments. Speedy and effective claims handling is the basis for great customer management. The analysis helps identify trends in claims, loss patterns and helps reduce risk of fraud and ineffectiveness.

Data mining tools are used to develop refined claims estimation models. The estimates are set aside as cash reserves which would not be used for long-term investment. Accurate estimates go a long way in impacting the profitability of the company.

Finance and assets management

Business intelligence allows the integration of finance data sources into a Financial Data Warehouse. Information here is analyzed that facilitates budgeting; models can be developed using BI tools to measure the insurers’ exposure to various risk factors like change in the interest rate structure. Prompt decision making with regards to investments is enabled since the tools provide accurate, timely financial reports.

Human Resource management

BI tools align manpower allocation strategies. Sales teams can be deployed in locations with high demand projections or locations that have projections most likely to increase.

Maintaining accurate employee data improves effectiveness. Tracking performance, payroll, and days worked and days on leave is made easier with easy to access interactive interfaces where data can be entered easily.

Pricing strategy

Business intelligence provides techniques that leverage claims policies, loss and other data stored in a data warehouse to determine the right amount to be charged on premiums.

Fraud detection

Insurance fraud is a threat that’s faced on a frequent basis. Business intelligence helps mitigate that threat. BI tools identify patterns that lead to fraud and can set up automated alerts.

Increasing profitability

Factors like product line, region, agency and customer segment are analyzed to crosscheck historical and current performance. BI allows predictive modelling to estimate marketability of individual products, product lines and investments. This allows the support of decisions towards investments that guarantee high returns.

Corporate management

Business intelligence allows for the incorporation of industry benchmarks to ensure that the company stays ahead. Periodically generated reports ensure that the company stays within state regulations. The reports are provided to government bodies and trade consortiums.

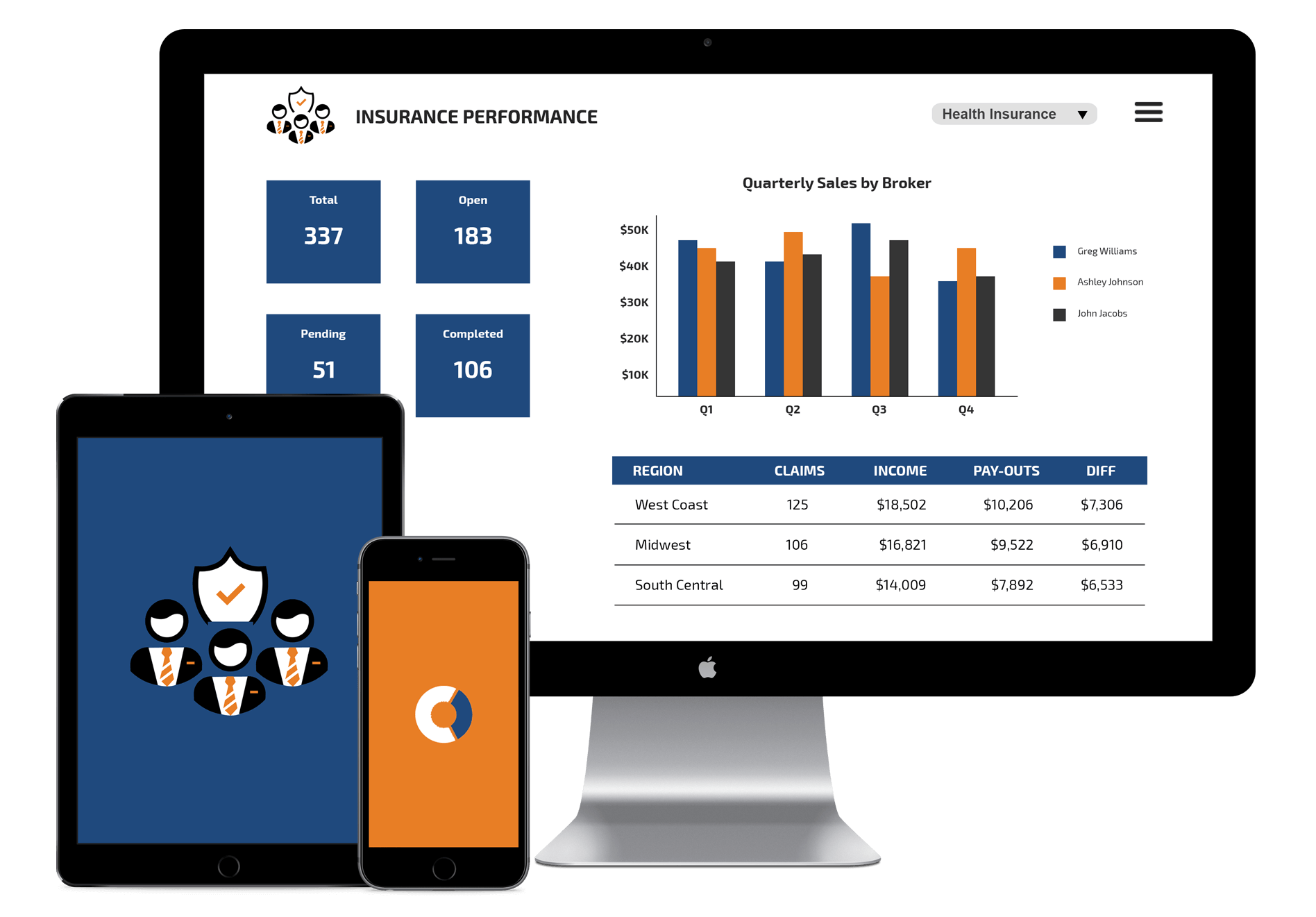

Top management view dashboards that have key metrics such as profitability, overall underwriting costs, ROI. The information provided expedites decision making that leads to sustainable business practices.

Photo Courtesy of shine.com

Pathways International implements BI an insurance environment based on data warehousing, data mining and online analytical processing. These practices help cover the leveraging of ever increasing data sources. We ensure that, as data becomes an integral part of decision making processes, that company objectives are met in a simple, cost effective way that is guaranteed to ensure your business can envision its growth.

Guesswork is completely eliminated. And you are sure that you will gain that competitive edge because you don’t estimate. You know.

Choose Pathways International today, and lead with your data.

Contact us for a demonstration.

Visit us at: 3rd floor Block B, Saachi Plaza along Argwings Kodhek, Kilimani, Nairobi.

Phone: +254-771-616- 839

Email: info@pathways-international.com